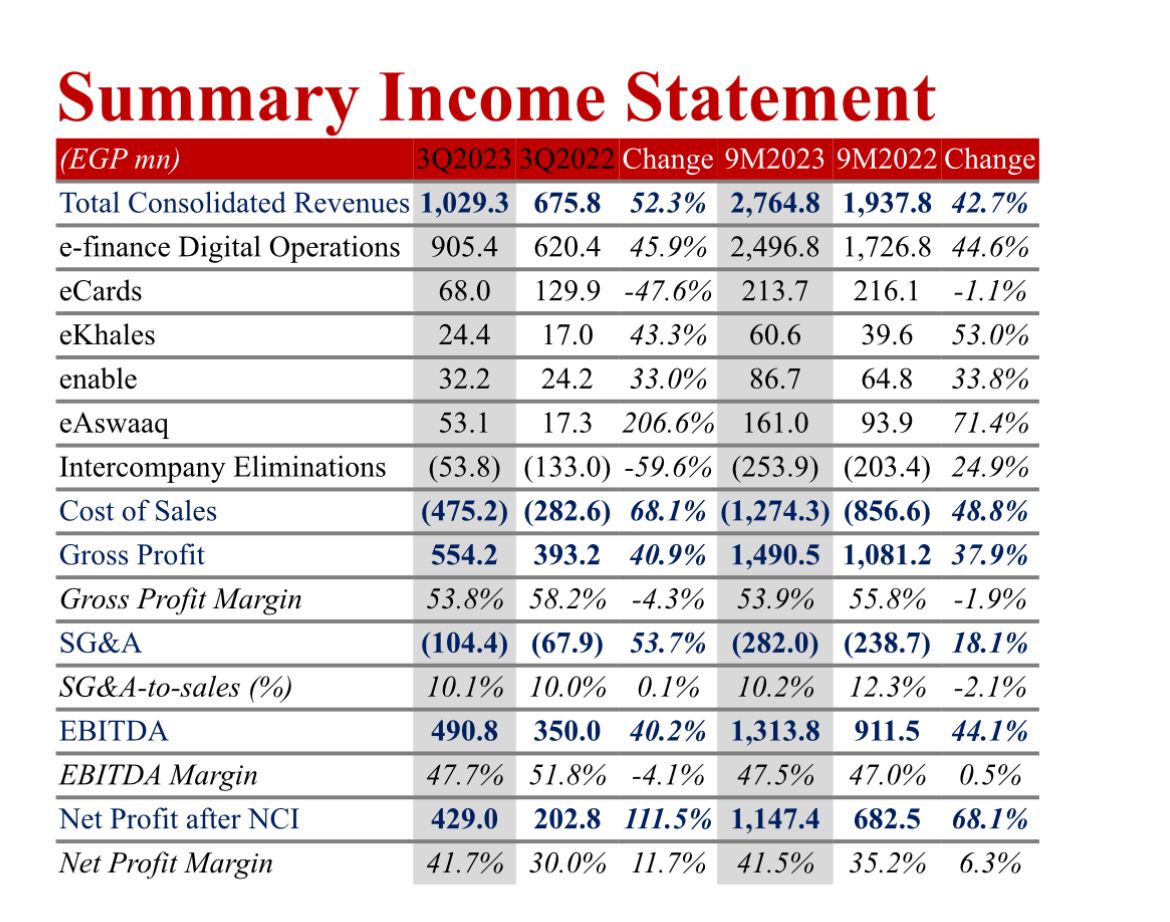

e-finance for Digital and Financial Investments S.A.E. (“e-finance”, or the “Group”, EFIH.CA on the Egyptian Exchange), a leading technology-focused investment firm in Egypt, announced today its standalone and consolidated results for the nine-month period ended 30 September 2023. The Group’s consolidated revenues rose by 42.7% y-o-y to EGP 2,764.8 million as the Group reaped the rewards of strong performances from its portfolio of subsidiaries. Strong top-line results trickled down to the Group’s EBITDA, which expanded by 44.1% y-o-y to EGP 1,313.8 million. At the bottom-line, e-finance’s net profit after non-controlling interest (NCI) surged by 68.1% y-o-y to EGP 1,147.4 million, yielding a y-o-y net profit margin increase of 6.3 percentage points to 41.5% during the nine-month period.

e-finance’s consolidated revenues increased by 42.7% y-o-y to EGP 2,768.4 million in 9M2023 following strong broad-based growth across the Group’s subsidiaries. e-finance Digital Operations was the primary revenue growth driver as the subsidiary reported solid results across all its business segments, followed by solid results from eCards, eKhales, and enable. On a quarterly basis, the Group saw its top-line expand by 52.3% y-o-y to stand at EGP 1,029.3 million at the close of 3Q2023.

The Group’s flagship subsidiary, e-finance for Digital Operations accounted for the lion’s share of the Group’s revenues in 9M2023, with a contribution of 90%. The subsidiary achieved a 47.6% y-o-y revenue expansion to EGP 2,490.8 million after inter-company eliminations in 9M2023. The subsidiary’s performance came on the back of solid results in its transaction revenue, its cloud hosting services, as well as its build & operate services. Transaction revenue was up 59.1% y-o-y, reaching EGP 960.0 million and driven by a 76.8% y-o-y increase in variable fee revenues to EGP 576.1 million, as well as a 38.3% y-o-y rise in fixed fee revenues to EGP 383.9 million in 9M2023. In parallel, cloud hosting revenue was up 59.8% y-o-y and stood at EGP 883.6 million in 9M2023, while the subsidiary’s build & operate segment achieved a 16.0% y-o-y increase in revenue to EGP 623.6 million during the nine-month period.

Revenue at eCards witnessed a 39.2% y-o-y increase to EGP 162.6 million after inter-company eliminations in 9M2023 on the back of a 125.7% y-o-y surge in card management revenue to EGP 117.1 million. eKhales reported a 34.9% y-o-y increase in post-elimination revenue to EGP 45.5 million in 9M2023 driven by an increase in the POS terminal network coupled with higher transaction volumes, and in parallel, enable’s revenue after inter-company eliminations expanded by 23.1% y-o-y to EGP 51.1 million in 9M2023. Revenue growth was driven by higher full outsourcing revenue, as well as expansions in both IT outsourcing revenues and HR outsourcing revenues. At eAswaaq, post-elimination revenue 73.9% y-o-y to EGP 14.7 million in 9M2023, compared to the EGP 56.4 million achieved in 9M2022. The revenue drop was a result of the high-base effect of a one-off supply revenue contract reported during the same period last year.

Consolidated gross profit rose 37.9% y-o-y in 9M2023, reaching EGP 1,490.5 million. However, GPM dropped by 1.9 percentage points y-o-y, closing the nine-month period at 53.9% on the back of an increase in cost of sales as a percentage of consolidated revenue. On a quarterly basis, the Group’s gross profit was up 40.9% y-o-y to EGP 554.2 million in 3Q2023, while GPM contracted by 4.3 percentage points y-o-y to 53.8%. GPM contraction was largely attributed to a retroactive collection of cloud services – which took place in the third quarter of the year for services that were rendered during the previous two quarters – resulting in a high-base effect on margins.

e-finance’s net profit after NCI surged by 68.1% y-o-y to EGP 1,147.4 million, yielding an NPM margin expansion of 6.3 percentage points y-o-y to 41.5% in 9M2023 on the back of higher operating profitability during the period.

Commenting on the Group’s performance, e-finance Chairman Ibrahim Sarhan said: “The Group has kicked-off the second half of the year on an impressive note and has booked record results across the board, with our performance across all metrics continuing to reflect our innovative approach to doing business, the operational strength of our portfolio companies, the rewards generated from our growing investments across key sectors, as well as the rising demand for digital solutions from the sectors, businesses, and people we serve.

In 9M2023, the Group achieved a top-line expansion of 42.8% year-on-year, with revenues reaching EGP 2.8 billion. Revenue growth was mostly driven by our flagship subsidiary e-finance Digital Operations, which delivered solid results across its business segments on the back of the continued investment in our cloud services offering, as well as the strong growth witnessed in transaction revenue. During the nine-month period, the subsidiary saw its variable-fee transaction revenue increase by 76.8% year-on-year as it continued to generate positive returns from the increased adoption of digital payment solutions across a number of key sectors. Parallel to this, revenue growth was further boosted by solid contributions from eCards, eKhales, and enable. At the Group’s bottom-line, we booked a milestone achievement, with e-finance’s net income surpassing the EGP 1 billion mark for the very first time, reflecting an increase of 68.5% y-o-y in 9M23 and yielding an associated margin expansion of 6.3 percentage points to 41.6%. This milestone continues to reflect our ability to generate strong returns from our higher margin revenue streams, the overarching strength of e-finance’s business model, and our team of exceptional professionals who form the bedrock of our success.

On the investments front, I am pleased to announce that our investments in the tourism sector are delivering exceptional returns, and we are aiming to increase our presence within the sector by doubling the number of touristic sites served by our digital ticketing solution. Further on this front, we are also looking to introduce new digital products with significant value-added potential to the sector. While we are aware that the current geopolitical tensions will potentially affect the number of tourists visiting Egypt in the near future, however, in the long-term, we are positive that the sector will continue to be an important pillar of Egypt’s economic growth strategy. Accordingly, the Group will continue working on capitalizing on the significant upside of the tourism sector to fuel our growth through the expansion of our footprint, as well as the introduction of new digital services and solutions.

In parallel, our associate company e-Tax continues to exceed our expectations and is on track to record a three-fold increase in its bottom-line by the end of the current year. Through its e-receipt, payroll, and core tax systems, e-Tax continues to generate exceptional returns. Accordingly, the company has become a prominent example of a highly successful investment that has completely paid back its invested capital and is now generating solid and consistent returns. Similarly, our recent investments in the agriculture sector have also started to bear fruit, and this quarter we have started recording revenues from our fertilizer distribution contract, which was signed and announced earlier this year and will significantly contribute to the Group’s performance going forward given the size and comprehensive scope of the contract.

I would also like to highlight a recent announcement made by the Group regarding the development of the new National Program for Development of Automotive Manufacturing and Assembly in Egypt, which we believe holds enormous growth potential for the Group, and for the country. The program entails the creation of a platform for automating the entire automotive industry, connecting factories and assembly plants with car dealers and car parts suppliers in order to facilitate a smoother and more efficient process across the entire automotive value chain, from manufacturing and assembly, to sales and distribution. This comprehensive program will not only allow the Group to further drive growth and generate increased value from our cloud and e-invoicing subscription services, but also further cement e-finance’s position as the partner of choice for digital transformation in Egypt.

Moreover, regarding our efforts to further provide essential tools to ease the lives of the communities we serve, and to further our alignment with the Central Bank of Egypt’s (CBE) and the Egyptian Government’s financial inclusion strategy, I am pleased to announce that the Group will start rolling the “Disabled Card” program. The first phase of the rollout will take place over three years and will include three million individuals from a total of nine million disabled individuals. Our role will primarily revolve around the production and management of the cards, which is in line with our strategy to identify and tap opportunities that generate increased value for the Group’s stakeholders.

With regards to our geographical expansion strategy in the MENA, I am happy to report that we have acquired the license to begin operating in Saudi Arabia and are in the process of setting up our branch and operations, which will further elevate our partnership with Saudi Arabia’s Private Investment Fund (PIF) as we seek to secure a growing number of contracts in the Kingdom and provide targeted digital solutions in key strategic sectors. We look forward to the establishment of our first branch within the Kingdom, as it will represent our first step in accomplishing the Group’s ambitious regional expansion strategy, and I am optimistic about the opportunities our presence in the Kingdom will present us.

Overall, I am proud of the Group’s exceptional performance this past period, and I am confident that we will close out the year on a strong note as we continue to leverage the expertise of our people to deliver innovative digital solutions to the businesses and people we serve and as we capitalize on Egypt’s untapped potential,” Sarhan concluded.